Introduction

The Payroll Allowance and Deductions extension from PIT Solutions provides a streamlined way to manage employee allowances and deductions within your payroll system. This feature allows you to accurately record various types of allowances and deductions for each employee, ensuring that their compensation is calculated correctly.

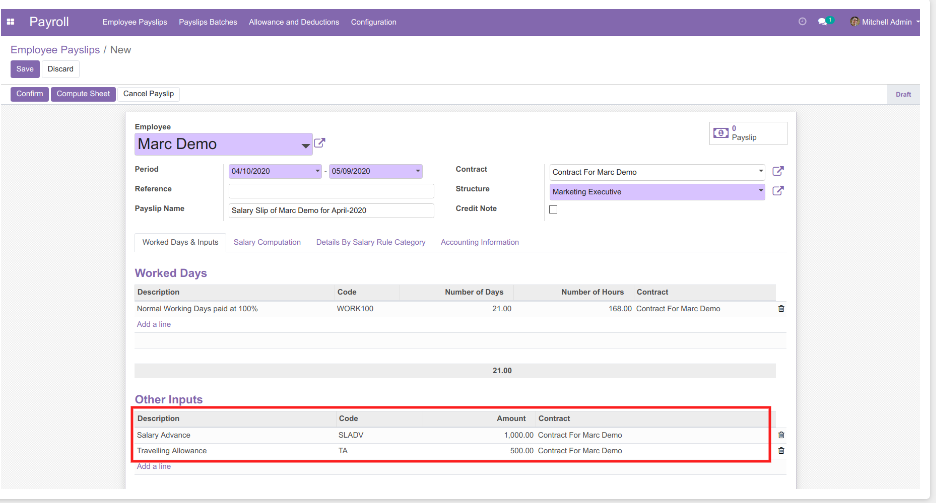

Once configured, the allowances and deductions you input for each employee will be reflected in the "Other Inputs" section of their corresponding payslip. This means that employees can easily see a breakdown of their earnings and deductions for each pay period.

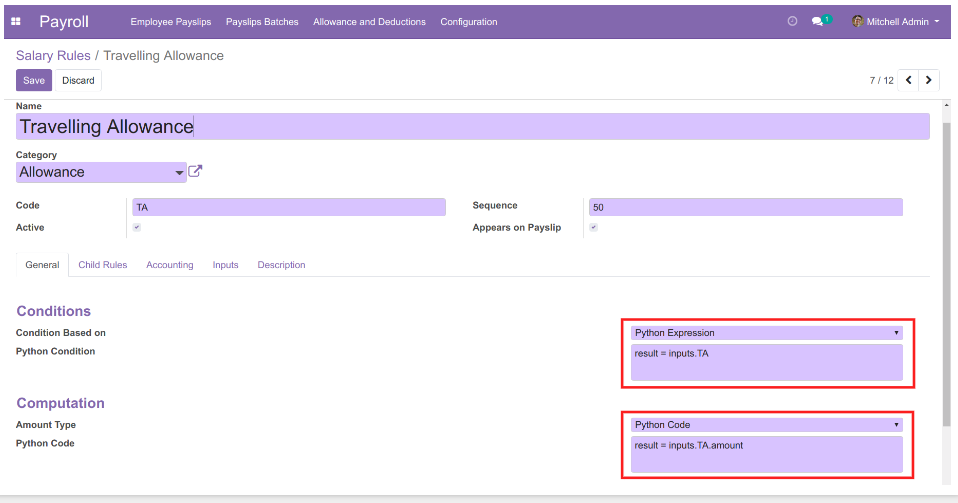

To make the most of this feature, it's essential to properly configure the associated salary rules. Salary rules determine how different types of input lines, such as allowances and deductions, are processed and calculated to determine the final salary amount.

Configuration Instructions

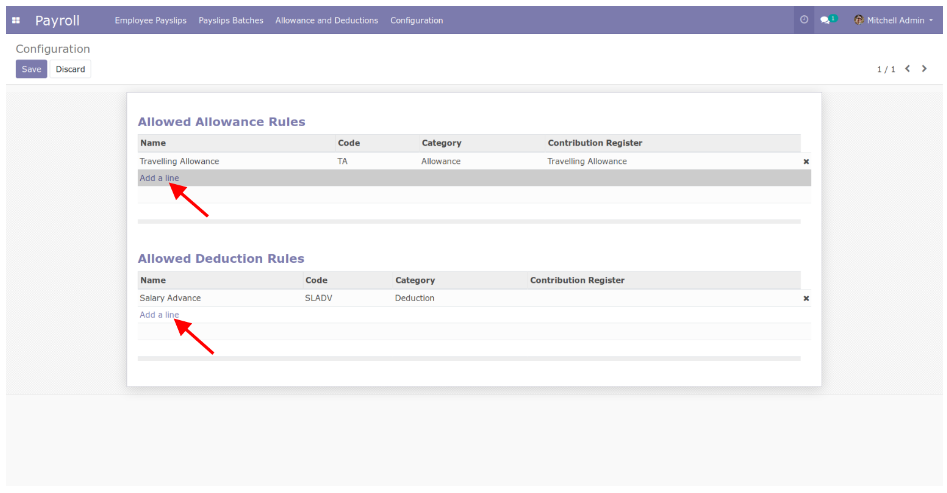

1.Set allowed Salary Rules

Go to Payroll --> Configuration --> ALW/DED Configuration

Choose the desired Salary Rules which are coming under category Allowance and Deduction. Please note that you can select a salary rule only if Inputs are configured under that particular salary rule.

2.ALW/DED Entry

Go to Payroll --> Configuration --> Allowance and Deductions

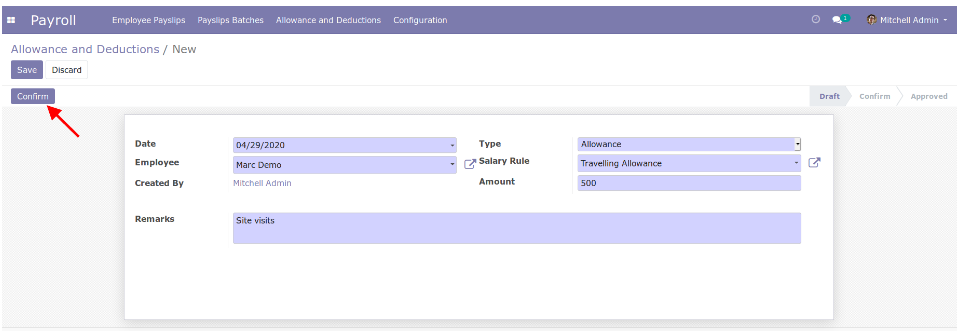

Enter all the required values. You can select a Salary rule only if it is allowed in the ALW/DED Configuration and is included in the salary structure of the particular employee.

After entering the details you can confirm the entry by clicking the Confirm button.

3. Approving ALW/DED Entry

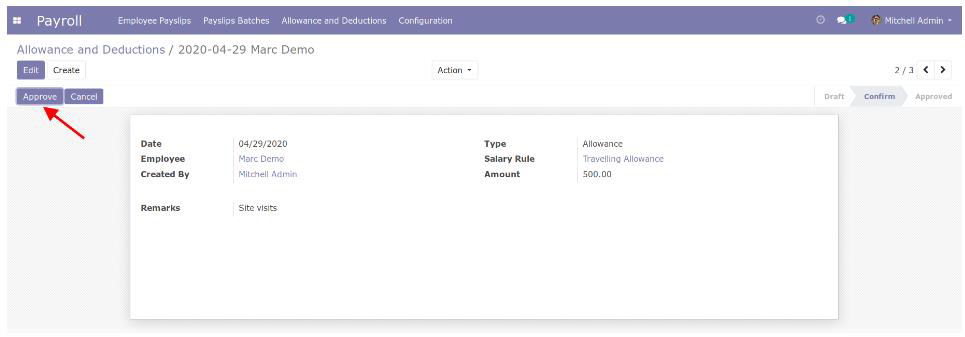

Click the Approve button to approve the entry

Only user with Payroll-Manager permission can Approve the record.

5.Employe Payslip

The approved Allowance and Deduction entries will available under the Other Inputs of the Payslip.

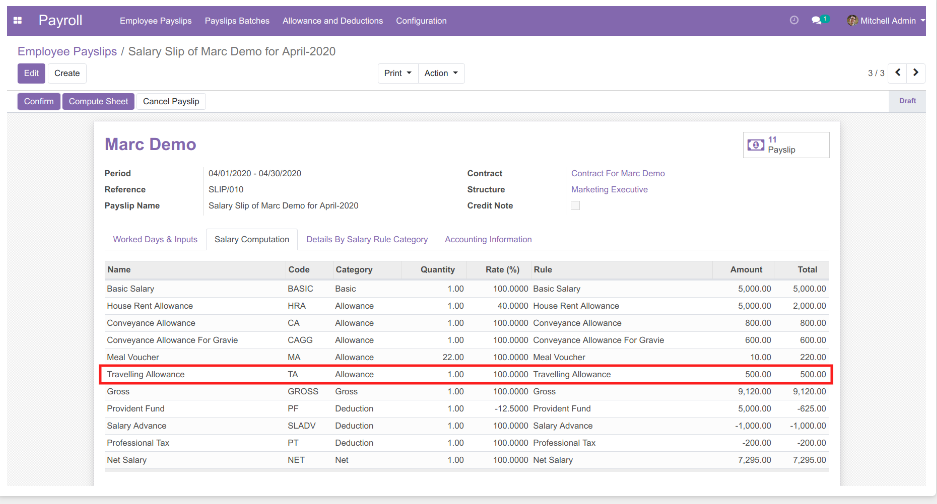

6. Salary Computation

With proper Salary Rule configuration, you can reflect these Inputs to the Salary Computation. For example:- Consider the salary rule configuration of Travelling Expenses given below

The salary computation will be